The Employees’ Provident Fund Organization (EPFO) has issued a series of critical alerts for its subscribers that PF Account Could Be Closed Soon, urging them to take immediate action to prevent their Provident Fund (PF) accounts from becoming dormant and to avoid restrictions on accessing their funds. These EPFO subscriber warnings focus on account inactivity, mandatory e-nomination, and ensuring updated Know Your Customer (KYC) details to safeguard members’ long-term savings.

The Core Mandate of the EPFO

Established under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952, the EPFO is one of the world’s largest social security organizations. Its primary objective is to provide financial security and a retirement corpus for salaried employees in India. The recent push for member vigilance is part of a broader strategy to streamline operations, reduce unclaimed funds, and enhance service delivery for its millions of subscribers.

Warning 1: The Risk of Inactive Accounts

A primary concern highlighted by the EPFO is the large number of inoperative accounts holding thousands of crores in unclaimed funds. An account is classified as inoperative or inactive if no contributions have been made for 36 consecutive months.

Financial Consequences of Inactivity

- The consequences of an account becoming inactive are significant. Most importantly, an inactive account stops earning interest, which currently stands at 8.25% for the 2024-25 financial year. This halt in compounding can lead to substantial financial loss over time.

- Furthermore, if an account remains unclaimed for seven years after being deemed inoperative, the funds are transferred to the Senior Citizen Welfare Fund (SCWF). While subscribers can still claim the money from the SCWF, the process becomes considerably more complex. To combat fraud, the EPFO has also tightened verification protocols for withdrawals from these dormant accounts.

Warning 2: Mandatory E-Nomination for Fund Security

- The EPFO is now strictly enforcing the requirement for all members to complete their e-nomination. An e-nomination is a digital declaration that designates the beneficiaries who can claim the accumulated PF savings and insurance benefits in the event of the member’s death.

- Recent updates to the EPFO member portal may restrict users from filing claims if their e-nomination is incomplete. This measure ensures that a member’s family can access funds without legal disputes or procedural delays. The process is entirely digital and can be completed through the EPFO member portal.

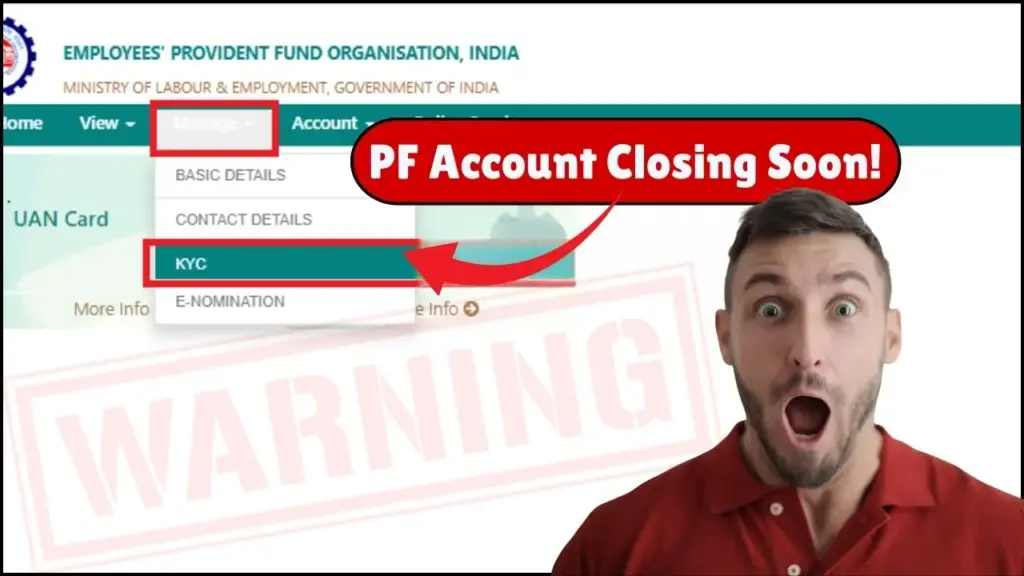

Warning 3: Strict KYC Compliance for Seamless Transactions

- Incomplete or mismatched KYC details remain a leading cause for the rejection of PF claims. The EPFO requires every PF account to be linked with the member’s Aadhaar, PAN, and a verified bank account to ensure transparent and secure transactions.

- Common KYC-related issues include incorrect bank account numbers or IFSC codes, and discrepancies in the member’s name or date of birth across official documents. While the EPFO has taken steps to ease the process, such as relaxing the mandatory uploading of cheque leaves in certain cases, the ultimate responsibility for data accuracy lies with the subscriber.

Protecting Your PF from Fraudsters: A Critical Advisory

Alongside these internal compliance warnings, the EPFO has intensified its efforts to caution members against rampant online fraud. Scammers often pose as EPFO officials to trick subscribers into revealing sensitive information.

Members are advised to follow these security protocols:

- Never share personal details: Do not disclose your UAN, password, PAN, Aadhaar, or bank details over the phone, WhatsApp, or email.

- Use official channels only: All services should be accessed through the official EPFO website or the UMANG app.

- Be wary of phishing: Do not click on suspicious links promising enhanced benefits or faster claim settlements. The EPFO never asks for money to process claims.

The Future of PF Services: What to Expect

In a move to enhance accessibility, the EPFO is planning significant service upgrades. Reports indicate that members may soon be able to make instant withdrawals of up to ₹1 lakh for emergencies via UPI or ATMs. Additionally, the organization is working on an IT system overhaul to enable auto-claim settlements for medical, educational, and housing advances, reducing processing times to as little as three days.

PF Account Could Be Closed Soon: A Step-by-Step Guide to Secure Your PF Account

In light of these warnings and developments, the EPFO advises all members to take the following steps:

- Review Account Activity: Log in to the member portal to check if the account is active and if contributions are being regularly credited.

- Consolidate Old Accounts: If you have changed jobs, use the online transfer facility to merge all previous PF balances into your current account. This prevents accounts from becoming inoperative.

- Complete E-Nomination Immediately: Update your nomination details on the portal to protect your family’s interests and ensure uninterrupted access to your account.

- Verify KYC Details: Meticulously check that your Aadhaar, PAN, and bank account details are correctly seeded and verified.

By being proactive, members can safeguard their retirement savings, ensure continuous growth through interest accrual, and guarantee that they or their families can access the funds without difficulty when needed.