Millions of Indian employees rely on the Provident Fund (PF) for retirement security, but many remain uncertain if their employers are depositing contributions on time. With digital tools provided by the Employees’ Provident Fund Organisation (EPFO), workers can now verify deposits instantly and raise complaints if discrepancies occur.

Why Provident Fund Deposits Matter

The Provident Fund is a government-backed savings scheme designed to provide financial stability after retirement. Under the Employees’ Provident Fund and Miscellaneous Provisions Act of 1952, both employers and employees must contribute 12 percent of an employee’s basic salary each month.

Experts warn that delays or failures in employer deposits can undermine workers’ long-term financial security. S. K. Singh, a former EPFO commissioner, said, “Employees often discover late that their PF accounts were not credited for months. By then, legal remedies become harder.”

How to Check Your PF Contributions

Using the EPFO Portal

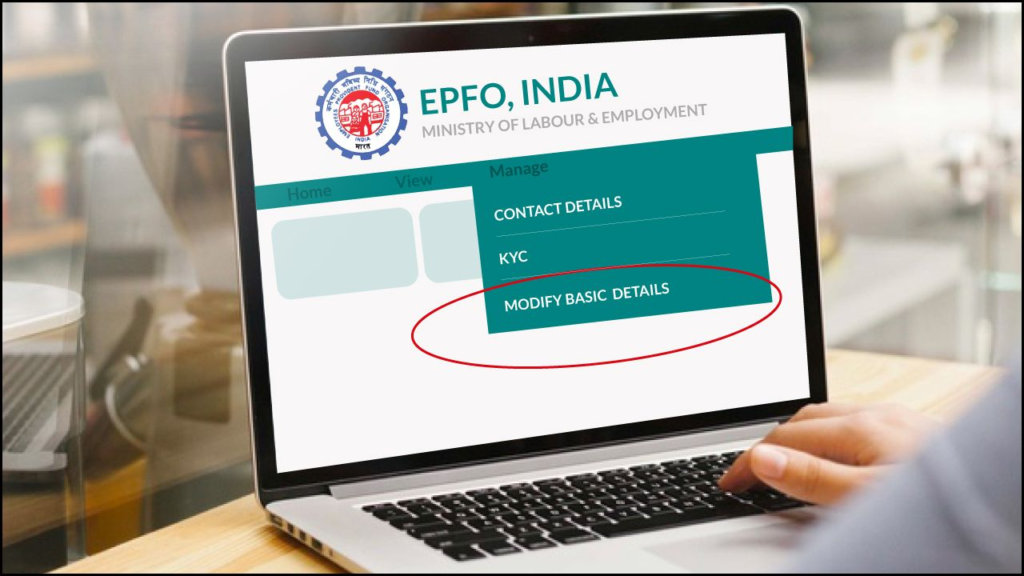

Employees can log in to the EPFO Member e-Seva portal with their Universal Account Number (UAN) and password. By accessing the passbook section, workers can view detailed monthly entries showing both employee and employer contributions.

Through the UMANG Mobile App

The government’s UMANG app also provides access to passbooks and contribution histories. Once logged in with a registered mobile number, employees can check recent transactions. The app is particularly useful when the EPFO website experiences downtime.

SMS and Missed Call Services

Workers can send an SMS with the text “EPFOHO UAN ENG” to 7738299899 from their registered number. They can also give a missed call to 9966044425. Both services return the balance information via SMS. However, they show only totals, not monthly breakdowns.

Common Issues and Red Flags

Several employees have reported cases where deductions appeared on payslips, but employer deposits were delayed or missing in the PF passbook. According to the Ministry of Labour and Employment, employers are legally required to remit contributions by the 15th of the following month. Failure to comply can result in penalties and prosecution.

Rituparna Chakraborty, co-founder of staffing firm TeamLease Services, noted, “Non-compliance not only harms employees but also exposes companies to legal risks and reputational damage.”

What to Do If Your Employer Is Not Depositing PF

- Verify records: Compare salary slips with PF passbook entries.

- Contact HR or payroll: Seek clarification and request proof of deposits.

- File a grievance: Use the EPFO’s online grievance redressal portal (EPFiGMS).

- Seek legal recourse: If unresolved, employees can escalate matters to regional PF offices or file a case under labour law.

The Bigger Picture

India’s provident fund system covers over 65 million active members. While digital tools have made verification easier, experts argue that stronger monitoring and faster grievance redressal are needed to protect workers.

Dr. Arpita Mukherjee, a professor at the Indian Council for Research on International Economic Relations (ICRIER), said, “The PF framework is robust, but enforcement remains uneven. Increased awareness among workers is the best safeguard.”

Conclusion

The Provident Fund remains a cornerstone of retirement planning for Indian employees. By using EPFO’s online and mobile services, workers can instantly confirm whether their employers are meeting legal obligations. Vigilance, combined with timely complaints, ensures that employees secure the savings they are entitled to.