The debate between the Employees’ Provident Fund (EPF) and the Public Provident Fund (PPF) continues to shape savings choices for millions of Indians. With the government fixing the EPF interest rate at 8.25% for 2024-25 and PPF offering 7.1%, investors face a key question: which scheme provides better long-term returns?

Understanding the Two Schemes

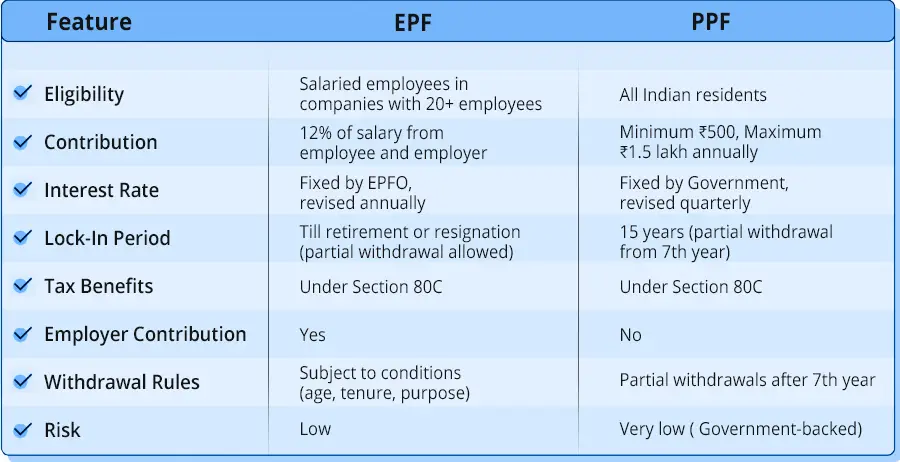

The EPF is a retirement savings plan mandated for salaried employees in eligible organisations. Both the employee and employer contribute a share of the worker’s salary, creating a growing fund.

The PPF, introduced in 1968, is a voluntary government-backed scheme open to all Indian residents, including self-employed workers. It has a lock-in period of 15 years and is widely used for its tax benefits and safety.

Current Interest Rates and Returns

- EPF: In March 2025, the Finance Ministry confirmed that the EPF rate would remain at 8.25% for FY 2024-25, the highest in three years, according to the Ministry of Labour and Employment.

- PPF: The PPF continues to yield 7.1%, unchanged for several quarters, according to the Ministry of Finance’s official notification.

Experts note that EPF has consistently delivered higher nominal rates. The added employer contribution further boosts its effective yield, making it particularly attractive for salaried employees.

Tax Treatment and Withdrawal Rules

Both schemes qualify for tax benefits under Section 80C of the Income Tax Act, allowing contributions up to ₹1.5 lakh annually.

- EPF: Contributions, interest, and maturity amounts are largely tax-free, provided the employee has completed at least five years of continuous service. Partial withdrawals are permitted for specific purposes such as housing, education, or medical needs.

- PPF: The PPF enjoys “Exempt-Exempt-Exempt” (EEE) status. All contributions, accrued interest, and maturity proceeds are entirely tax-free. Withdrawals are restricted until the seventh year, with full redemption only after 15 years.

Expert Perspectives

“From a purely returns perspective, EPF is ahead of PPF, especially with the employer contribution factored in,” said Anil Gupta, senior partner at EY India’s tax practice, in an interview with The Hindu BusinessLine.

However, financial planners emphasise that PPF has unique advantages. “PPF offers unmatched stability and accessibility for the self-employed. For those outside salaried jobs, it is often the most reliable long-term savings vehicle,” said Rachna Dhoot, certified financial planner at Finsafe India.

Who Should Choose Which?

- EPF is better suited for salaried employees seeking higher effective returns through employer contributions and stable long-term growth.

- PPF is ideal for self-employed individuals, retirees, or anyone looking for guaranteed tax-free returns with government backing.

Diversification remains a common recommendation. “Both funds serve different needs, and maintaining exposure to each provides balance and security,” noted Soumya Kanti Ghosh, Group Chief Economic Adviser at State Bank of India, in a recent report.

Conclusion

In the EPF vs PPF debate, the EPF currently delivers higher returns when factoring in both interest rates and employer contributions. The PPF remains a safe, tax-efficient, and inclusive option for individuals outside the formal workforce. Experts advise that the choice should depend on employment status, risk appetite, and liquidity needs.