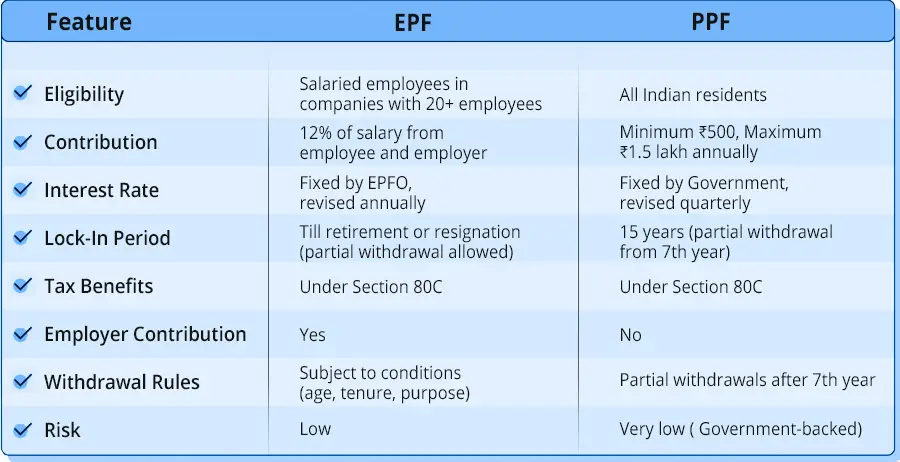

India’s two most popular long-term savings schemes, the Employees’ Provident Fund (EPF) and the Public Provident Fund (PPF), continue to attract millions of investors seeking secure, tax-efficient returns. As interest rates fluctuate and retirement planning gains urgency, the EPF vs PPF debate has intensified among salaried and self-employed individuals.

What Are EPF and PPF?

The Employees’ Provident Fund (EPF) is a government-managed savings scheme mandated for many salaried employees in the organised sector. Both employers and employees contribute, with the current rate set at 12 percent of basic salary plus dearness allowance. The fund is administered by the Employees’ Provident Fund Organisation (EPFO).

By contrast, the Public Provident Fund (PPF) is voluntary and open to all resident individuals, including the self-employed and those without formal employment. It requires a minimum deposit of ₹500 per year and allows a maximum of ₹1.5 lakh annually. The scheme is overseen by the Ministry of Finance and is considered one of the safest savings instruments in India.

Interest Rates and Returns

The government reviews interest rates for both schemes annually or quarterly.

- For the financial year 2024–25, the EPF offers 8.25 percent interest, according to the Ministry of Labour and Employment.

- The PPF currently offers 7.1 percent per annum, as notified by the Department of Economic Affairs.

Although the EPF provides higher nominal returns, the compulsory employer contribution often amplifies the overall corpus for salaried individuals.

Tax Benefits

Both schemes fall under Section 80C of the Income Tax Act, offering deductions up to ₹1.5 lakh annually. However, the tax treatment varies:

- PPF operates on the Exempt-Exempt-Exempt (EEE) model. Contributions, interest, and maturity proceeds are tax-free.

- EPF is also largely tax-exempt, but withdrawals before five years of continuous service may attract tax on contributions and interest.

According to tax experts at Deloitte India, this distinction makes PPF particularly attractive for investors with irregular employment histories.

Liquidity and Withdrawal Rules

EPF balances can be partially withdrawn for specific needs, such as home construction, education, or medical emergencies. Full withdrawal is permitted at retirement or upon two months of unemployment.

PPF carries a strict 15-year lock-in period, though partial withdrawals are allowed from the seventh year onwards. Extensions in blocks of five years are possible, making it suitable for disciplined, long-term investors.

Suitability for Different Investors

Experts note that suitability depends largely on employment type and income stability.

- Salaried employees benefit more from EPF due to the employer’s matching contribution.

- Self-employed or informal sector workers may prefer PPF, which does not rely on employer participation.

- High-income earners often use both schemes, diversifying savings while maximising tax exemptions.

“EPF is often the backbone of retirement savings for salaried employees, while PPF provides flexibility and guaranteed tax-free returns for others,” said Dr. Radhika Gupta, an economist at the National Institute of Public Finance and Policy.

Long-Term Wealth Implications

Illustrative calculations show that a salaried employee earning ₹50,000 per month and contributing to EPF could accumulate a significantly larger corpus than a PPF investor contributing the maximum ₹1.5 lakh annually, mainly due to the employer’s matching contribution and higher interest rate.

However, PPF’s predictable tax benefits and government backing make it an essential tool for investors seeking certainty. Analysts warn that neither scheme alone may be sufficient to counter inflation, recommending a diversified portfolio that includes equities.

Conclusion

Both EPF and PPF remain cornerstones of India’s savings landscape. EPF typically offers higher returns for salaried employees, while PPF ensures tax-free stability for self-employed investors. Financial planners emphasise that choosing between the two depends on income profile, risk appetite, and long-term financial goals.